- Announcements

- Bitcoin

- Ethereum

- Hemi

- Learn Center

- March 12, 2025

A Guide to Hemi’s Mainnet

Welcome to the Hemi Mainnet!

The Hemi team has worked to ensure our platform is valuable to everyone from Day One. Here is everything you can do on our platform right now on Mainnet Day.

Table of Contents

Hemi bridges the gap between the distinct worlds of Bitcoin and Ethereum like no other network. For Bitcoin users, it provides new opportunities to utilize your BTC effectively. For Ethereum users, Hemi delivers the scalability and performance expected from an L2, along with native access to Bitcoin’s security, data, and deep liquidity.

This wouldn’t be possible without the contributions of all the Day One participants in the Hemi ecosystem — those who share the vision of One Network, powered by Bitcoin and Ethereum.

Explore the wide range of possibilities available on Hemi from the very beginning.

For Users

Hemi integrates with leading decentralized exchanges (DEXs) to make token swaps seamless, secure, and efficient. DeFi on Hemi allows for the native integration of Bitcoin alongside the full gamut of EVM-supported tokens, creating new opportunities for Bitcoin holders to generate passive income via liquidity provision and yield farming. On day one, users can trade popular tokens like xBTC, yBTC, zBTC, and WETH across the following platforms:

- Sushi – Trade on the Sushi DEX, featuring an automated market maker, yield farming, optimizations for efficiency with a dAPP interface, and community-driven governance.

- iZumi – A multi-chain DeFi protocol providing One-Stop Liquidity as a Service (LaaS).

- DODO – Trade on a DEX featuring a Proactive Market Maker (PMM) built to increase capital efficiency and reduce slippage. DODO also offers fair token launches with crowdpooling, and single-sided liquidity provision enabling users to farm with a single asset rather than a balanced pair. The PMM algorithm maintains the balance of the pool.

- Atlas – Hemi’s native DEX provided by Algebra Finance that will implement a v4 architecture to enable hooks and additional yield-generating opportunities for liquidity providers.

- Oku (Uniswap): A non-custodial meta-aggregator for EVM featuring access to advanced analytics and a dashboard from which traders may enter or exit positions via market or limit orders, manage various liquidity positions, and convert to and from fiat currencies via integrated onramps.

- PassDEX: A multi-EVM chain DEX allowing users to swap, provide liquidity, and earn rewards built around rewards and community-driven governance to drive participation.

Maximize asset utility with Hemi’s integrated lending platforms. Lending on Hemi is uninhibited, empowering individuals holding crypto who may be underserved or sidelined by traditional institutions to borrow, lend, and grow their assets in a decentralized environment. These protocols allow you to lend tokens and earn interest, making your holdings work for you. Day One integrations include:

- Layerbank – Access a scalable, secure, and efficient institutional-grade lending protocol, designed for larger liquidity providers and sophisticated users that facilitates high-volume lending and borrowing with competitive interest rates.

- LendOS – With LendOS, find flexible borrowing and lending solutions, tailored for retail users. With its decentralized and transparent tools, LendOS offers liquidity or opportunities to earn interest beyond the scope of what is typically available in the traditional banking system.

- ZeroLend – Explore a lending market for DeFi lending, liquid restaking token (LRT) lending, and real-world asset (RWA) lending on a fully audited, custody-free platform.

- AJNA – Participate in peer-to-pool permissionless lending pools serving lenders and borrowers, functioning free of governance or price feeds.

Hemi also connects the gap between other networks, enabling effortless cross-chain transfers. Tunnels to Hemi are completely sovereign, and decentralized, without intermediaries or central providers. Tunneled assets serve as direct on-chain collateral, promoting trustless and secure interactions. Day One cross-chain solutions include:

- Native Tunnels between Bitcoin/Hemi and Ethereum/Hemi

- Stargate – Send assets to another network with instant finality, and without asset wrappers. Stargate is a delay-free cross-chain solution tailored for applications that require real-time reliable liquidity across networks.

- Free Tech – Free Tech tunnels are built around user sovereignty, supporting Bitcoin transfers while catering to participants who value decentralization.

- Meson – Swapping stables? Meson enables rapid cross-chain asset transfers with minimal slippage, optimized for stablecoins. The protocol leverages an aggregation model, with optimized routing to reduce fees for a cost-effective solution.

- OOOO – Cross-chain interoperability boosted by AI Omninet, which provides automation for such activities.

For traders looking to explore perpetual swaps, Hemi will integrate Artura, a powerful platform offering access to perpetual futures trading, competitive fees and deep liquidity. Take leveraged positions on Bitcoin, and a wide range of emerging Bitcoin-based assets including Ordinals, BRC-20, and Runes.

Synthetic assets provide on-chain opportunities for exposure to financial instruments that replicate the value and behavior of an underlying asset, whether from the crypto sector or from traditional markets. Hemi day one integrations include:

- Metronome: Create a wide array of synthetic assets, supported by collateral from many chains, with zero slippage on swaps between synthetic assets.

- Satoshi Protocol: Use Bitcoin as collateral to support the issuance of satUSD, a synthetic stablecoin designed for broader utility within DeFi.

- Sumer.Money – Prioritize capital efficiency and security, supporting correlated asset positions for ETH, LSTs, and LRTs, and uncorrelated positions for ETH and USDC. Create synthetics of suUSD, suETH, and suBTC backed by the same lending deposit to participate in DeFi across ecosystems while native assets reside on their origin chains.

Hemi is your gateway to yield-generating strategies, whether by staking or providing liquidity. On Day One, you can access:

- Swell’s earnBTC – Deposit an EVM-based Bitcoin of choice and earn protocol points and yield while it remains on a fully audited platform with low annual fees.

- BitFi – Take assurance with a professional custody service secured by CEFFU that plies proven quantitative trading strategies, with a comprehensive risk management team. BitFi supports BTC, BTCB, and WBTC to mint bfBTC which backs its fully transparent liquid staking and yield-generating ecosystem.

- BounceBit Vault – Access asset management secured by CEFFU, with automatic or manual portfolio maintenance, and earn yield on Bitcoin and stables in BounceBit’s staking vaults.

- DeSyn – DeSyn equips portfolio managers with advanced tools, to build custom on-chain portfolios, and provide investors with diverse DeFi opportunities. Its smart contract-driven processes ensure secure rebalancing, issuance, and withdrawals.

- Echo Protocol: Mint HBTC using Echo’s advanced and fully audited infrastructure and use the HBTC across the Hemi ecosystem to earn yield.

- VaultCraft: Deposit into VaultCraft vaults to maximize the yield you are earning on eligible assets. These vaults are managed by top market makers and deployed across the ecosystem using delta-neutral strategies.

- YieldFi: Deposit stablecoins into YieldFi to generate over 15% via delta-neutral trading strategies and receive their yield-bearing stablecoin, yUSD, in return.

Coming soon: Spectra – An EVM-based protocol, Spectra enables users to tokenize future yield and principle via interest-bearing tokens. Spectra offers permissionless access to create new markets, swap yield derivatives, or provide liquidity.

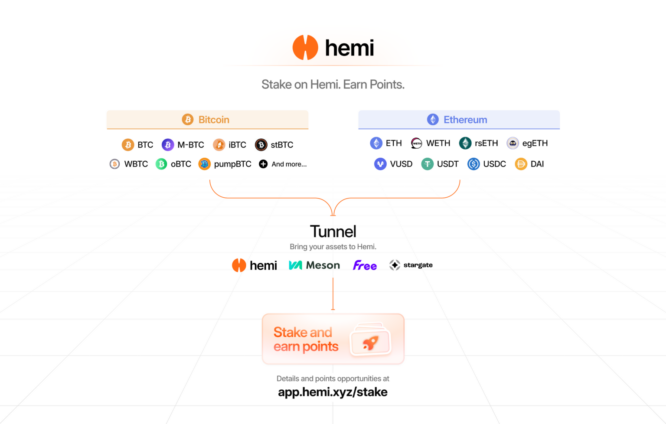

Hemi’s multi-asset staking platform is designed specifically to accommodate Bitcoin with a trust-minimized, secure approach that lets holders stake and earn without fear of slashing conditions. Hemi utilizes a fully audited staking reward smart contract, which is fine-tuned to allocate to depositors. These staked assets are not used to validate blocks, removing any slashing risks for participants.

Move assets in and out of the staking contract in minutes, subject to network confirmation times, without lengthy bonding or unbonding rounds, for equal access to staking rewards and liquidity as needed.

Compound your earnings with Hemi’s restaking solutions.

- Cygnus– By integrating Cygnus, a platform offering efficient delegation and restaking services for liquid-staked assets, Hemi enables you to maximize returns with ease. The automated mechanisms of Cygnus minimize manual intervention, reducing the barriers to passive yield opportunities across both EVM-based and Bitcoin-based ecosystems.

- Pell – Restake on an omnichain solution with Pell Network, and secure any of multiple connected networks, extending security, and functionality of decentralized validation services.

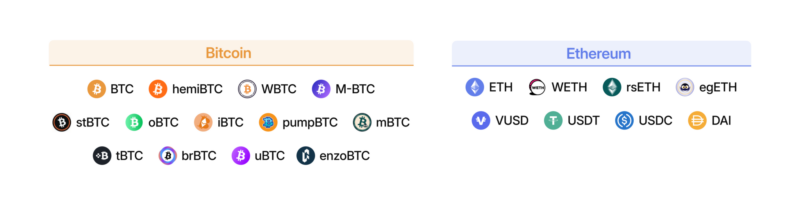

Hemi will offer native support to a number of tokens.

Kelp – Access a utility token on the Binance Smart Chain BEP-20 standard designed to incentivize liquidity management and market making. Kelp will employ automated strategies across protocols and exchanges to optimize the most efficient trading routes, and yields.

Bedrock (brBTC) – Stake supported forms of Bitcoin to Bedrock’s vault and receive liquid-staked brBTC, a restaking token backed by diverse BTC-based derivative assets that provides yield to holders.

pumpBTC – This liquid staking solution is powered by Babylon, with a platform built to provide high native base yields on forms of supported Bitcoin.

exSat Network (iBTC) – With iBTC, trade with a synthetic asset pegged to Bitcoin and ready for integration with wider DeFi ecosystems.

From the onset, Hemi cross-protocol integrations offer extensive and robust infrastructure support.

The Graph – Connecting to over 70 networks and supporting over 75,000 projects, The Graph offers structured data insights by indexing onchain data, enabling subsecond data queries. The network is decentralized and operated via a delegate and incentive-driven ecosystem powered by the GRT token.

Demos – A decentralized platform dedicated to preserving Web3 user privacy and autonomy. It utilizes biometric security to ensure genuine user interactions. Demos offers digital identity solutions in the form of its flagship product, OnlyMeID, which provides complete control over personal data, with discretional deletion post-verification.

LayerZero – An open-source immutable messaging protocol that facilitates cross-chain communication for interoperable dapps. LayerZero allows developers to send arbitrary data, make external function calls, or send tokens while maintaining autonomy over their applications.

Tenderly – A comprehensive suite of onchain tools and infrastructure solutions or Web3 development, built to help with testing, engineering, and monitoring of dapps. Tenderly offers support to 79 networks, with services including virtual testnets, contract verification, intuitive debugging, and much more.

Turtle Club – A decentralized protocol built to amplify rewards across, boosting yields while allowing for sovereign asset management. The club provides benefits for users who refer others, provide liquidity, route swaps through the network and partners, and participate in staking and delegation to validators.

For More Advanced Users

Hemi’s Proof-of-Proof consensus allows any participant to set up a miner and join in securing the network.

If you see something, say something. You, too, can earn monetary rewards for successfully discovering and reporting vulnerabilities. Go to our page on HackerOne for more information.

Here are the recommended tools for you to use:

- Remix: Easily write, test, and deploy smart contracts directly in the browser.

- Foundry: A fast, modular, and secure toolkit for smart contract development and testing.

- Hardhat: Manage smart contract workflows with debugging, deployment, and testing tools.

- Viem: Build reliable apps & libraries with lightweight, composable, and type-safemodules that interface directly with Hemi.

- Hemi Bitcoin Kit (hBK): Hemi’s proprietary Bitcoin SDK, enabling seamless Bitcoin integration within Solidity smart contracts.

- Safe (Gnosis): Create a Safe wallet to access world-class multisig wallet capabilities.

- Oracles: Enabling smart contracts on Hemi to access trustworthy off-chain data. Developers on Hemi can access push-based price feeds for Hemi with the oracles below:

- Pyth – this oracle specializes in real-time market data for low-latency financial applications, featuring institutional-grade data sources, onchain updates, price aggregation, and cross-chain data delivery.

- Redstone – this oracle uses a caching layer to offer data to smart contracts on an as-needed basis and avoids constant onchain updates. Redstone’s tailored data streams, multi-chain capabilities, and lightweight approach to onchain data strike a balance between cost efficiency and reliable data access.

- Contract Verification: Hemi supports contract verification with Blockcscout UI or HardHat verification plugin.

- Capsule: Capsule is an asset transfer protocol that allows anyone to batch and transfer multiple assets in a single package on Hemi.

- Pure Finance: EVM tools and smart contracts offering solutions for developers, DeFi applications, and individuals alike.

- Smarter NFTs: Create and mint smarter NFTs on Hemi to take advantage of Superfinality.

- Steer Protocol – With tools to optimize yields for liquidity pool participants, Steer offers automated strategy execution and performance monitoring. The platform enables simplified cross-chain protocol liquidity management while maximizing LP efficiency.

On Day One, any user can write (or move) their app (or data) to Hemi and get the security of Bitcoin at a tiny fraction of the cost. Any developer can write smart contracts in Solidity that use data directly from the Bitcoin blockchain, with no oracles or other integrations needed.