How Bitcoin DeFi Can Fuel the Next Market Boom

Bitcoin has long been left out of the DeFi equation. No longer.

In early January 2025, Solana’s stablecoin supply surged by 112%, a record high of $11.1 billion, driven by the frenzy of buyers clamoring to get a piece of President Donald Trump’s newly launched $TRUMP memecoin, attracting significant inflows. Questionable political coins aside, the token’s launch saw unprecedented success, surging at one point to $70 billion in market capitalization.

However, despite that impressive growth, the most liquid cryptocurrency of all, Bitcoin, was notably underrepresented on Solana’s network and remains so across a majority of DeFi applications.

Part of this has to do with the obstacles of freely moving Bitcoin across networks. Some $12 billion in bitcoin lies locked in wrapped versions of the asset like wBTC, which relies on custodial intermediaries. With such counterparties, operational bottlenecks and financial risk are introduced, which limits the broader integration of Bitcoin into DeFi.

Hemi can address the challenges of counterparty risk and operational constraints by eliminating intermediaries and enabling Bitcoin to flow freely into DeFi applications. By hosting a wide range of partners from its mainnet launch, Hemi prioritizes immediate utility for Bitcoin and ETH holders. Whether it be purchasing new assets on DEXs, including the native DEX Izumi, SushiSwap, or DODO, lending and borrowing with partners like LayerBank, LendOS, and ZenoLend, or taking part in a wide range of yield-earning, liquid-staking, and restaking services, Hemi is ready to serve.

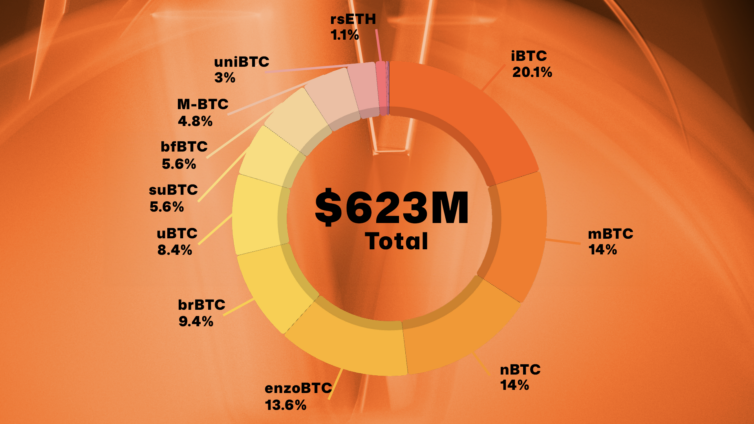

Since launch, Hemi has seen over half a billion dollars in total value locked (TVL), much of it in Bitcoin-backed assets that reflect growing demand for native BTC liquidity in DeFi. As of late March, Hemi had accumulated 1,411.375 iBTC via ExSat, 675 brBTC and 210.802 uniBTC via Bedrock, 400.1 suBTC via Sumer, and 1,000.316 mBTC via Magpie. Matrixport contributed 1,000 NBTC, and Eigenpie added 25.909 egETH, expanding the reach to ETH staking. This mix of assets shows that developers are not only building for Bitcoin but also integrating restaking and ETH-based strategies.

The recent surge in stablecoin activity on Solana demonstrates a growing appreciation for DeFi across a broadening market with new participants. It shows that there is an opportunity for a Bitcoin-integrated DeFi platform on Hemi to capture and put this demand to work, offering a deep base of liquidity ready to feed the next big market cycle.

With a rising number of supported assets and integration with multiple issuers and protocols, Hemi now represents both an appetite and a growing opportunity for Bitcoin-based assets in DeFi.

DeFi is continuing to evolve and gain traction, and the integration of Bitcoin free of any intermediary control or custody is crucial for it to live up to the purpose for which these networks stand. Hemi promises to achieve this, tunneling through centralized custody models for a truly sovereign path in and out of the network to and from origin and destination chains.

When the next big market wave hits, Hemi will be ready to accommodate this growing demand, tapping into Bitcoin’s vast liquidity.