- Announcements

- Rewards

- Security

- October 31, 2025

Introducing the Hemi Economic Model

Tying Value Creation of the Hemi Protocol to $HEMI Staking, Decentralized Economic Security, and Sustainable Bitcoin Yield.

Today, Hemi announces the initial Hemi Economic Model, which powers the future decentralization, economic security, and incentives for the Hemi ecosystem, defined in the Hemi Improvement ProPOsal: HIPPO-2.

In its first phase, the model will allocate a pool of 0.2445 hemiBTC and 100,320.69 $HEMI, derived and converted from transaction fees, to veHEMI stakers who staked $HEMI between August 30 and October 30, 2025. Visit the Hemi Portal to claim these staking incentives. Additionally, another 98,216.75 $HEMI purchased with transaction fees has been burned.

The launch of these rewards sets the stage for veHEMI to serve as the cornerstone of Hemi’s governance system, and more broadly, to enable secure network decentralization and sustainable liquidity incentivization for Hemi’s Bitcoin DeFi ecosystem.

Summary of The Hemi Economic Model

At a high level, the Hemi Economic Model is designed to:

- Connect $HEMI to the economic value created by the Hemi ecosystem

- Incentivize veHEMI to ensure adequate economic security for decentralized protocol components

- Stimulate BTC-based economic activity, focusing on sustainable yield

- Increase liquidity across Hemi’s DeFi protocols

- Build long-term protocol-owned liquidity

- Promote incentive alignment between Hemi and users seeking BTC yield

The implementation of the economic model will occur over several stages:

- Stage 1 (Today): Protocol fees and yield are converted into $HEMI and hemiBTC and distributed as yield to veHEMI holders, alongside a fees-to-$HEMI-burn mechanic

- Stage 2: Automated Short-Term-Pool (STP), which smooths out protocol asset distribution flow, and Protocol-Owned-Liquidity (POL) treasury, which allocates assets to increase liquidity across the Hemi ecosystem and generate additional yield

- Stage 3: Decentralized voting system for incentive distribution, including a vote market

- Stage 4: Dual staking (veHEMI + staked hemiBTC)

As Hemi continues to evolve, this economic system will become more powerful:

- Increasing protocol value generation:

- New features (hBitVM, veHEMI economic security system, PoP security inheritance, Chainbuilder DA / Shared Sequencing, cross-chain liquidity systems, etc.), which generate their own fees

- Increased adoption of Hemi, leading to greater fee inflows

- Increasing STP and POL yield:

- New dApps providing additional yield sources

- Increasing DeFi activity on Hemi generates additional yield on provisioned liquidity

- New asset management strategies unlock additional opportunities

This design provides a sustainable flywheel: value created by Hemi is directed back into powering economic security/decentralization and increasing liquidity while incentivizing ecosystem participants, which in turn enables even more value creation.

What is veHEMI?

Vote-escrow $HEMI (veHEMI) is the protocol-native $HEMI staking system, used for governance, economic security for decentralized components of the protocol, as well as directing allocated pooled protocol assets to act as incentives in the Hemi DeFi ecosystem.

Users stake $HEMI for a period of 12 days to 4 years, and receive an NFT representing their staked position. Longer lockups receive higher weight in the system, representing the increased incentive alignment with the long-term success of Hemi.

The weight of a position is calculated based on its remaining lockup time; for example, a position with 4 years remaining has twice the weight of a position with 2 years remaining, etc. Users can extend the lockups on existing positions to increase their weight and incentives.

As Hemi evolves, owners of veHEMI positions will earn additional incentives for:

- Participating in governance votes (or delegating)

- Operating decentralized infrastructure:

- Block sequencing

- Data publication to Ethereum (DA & state roots)

- hBitVM covenant emulation and vault operation

- Providing shared sequencing and DA services to Chainbuilder chains

- Providing cross-chain liquidity

- Providing economic security to third-party protocols

- Receiving yield from the vote market for directing incentives

When veHemi positions are used for economic security (decentralized infrastructure, cross-chain liquidity, and securing third-party protocols), they are subject to being slashed for misbehavior. Depending on the specific security needs of each protocol, the underlying $HEMI in the slashed position may be burnt, sent to either the STP or POL, and/or distributed to other protocol participants.

veHemi positions are transferable, meaning they can also be used as collateral in other DeFi protocols.

Economic Model Stage 1: Fee Distribution & Burn

Starting today, with the conversion of ~8.26 ETH in excess protocol fees to ~0.2445 hemiBTC and ~100,320.69 $HEMI in incentives distributed to veHEMI stakers and an additional ~1.51 ETH converted to ~98,216.75 $HEMI, which was burnt on Ethereum mainnet, the first stage of Hemi’s economic model is officially live.

Transaction details can be found here:

- Conversion of 7 ETH to 0.2445 hemiBTC:

- Conversion of 2.77 ETH to 198,537.44 HEMI:

- Burning of 98,216.75 HEMI:

And the $HEMI and hemiBTC reward configurations can be seen here:

- ~100,320.69 $HEMI in total rewards for Aug 30 – Oct 30:

- ~0.2445 hemiBTC in total rewards for Aug 30 – Oct 30:

Moving forward, a portion of protocol fees will be periodically collected and converted to $HEMI and hemiBTC, with a portion of the $HEMI burnt and the remainder, along with the hemiBTC, distributed as veHEMI incentives.

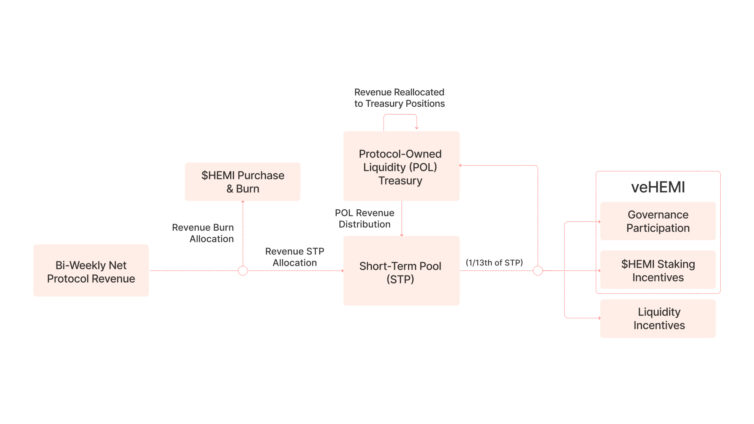

Economic Model Stage 2: Automated Short-Term

Pool and Protocol-Owned Liquidity Treasury

Stage 2 of the Hemi Economic Model introduces two economic components:

- Short-Term Pool (STP)

- Smooths out the balance of protocol economic throughput inflows versus outflows to provide more consistent incentive distribution

- Earns yield on its transient pool of assets with short-term strategies

- Protocol-Owned Liquidity (POL) Treasury

- Controls assets in perpetuity that are used to provision liquidity across the ecosystem

- Earns yield for the protocol with a permanent pool of assets, which can be deployed into long-term strategies

Every two weeks, the remaining net protocol fee surplus (gross fees minus non-inflation PoP incentives and ETH DA + state root publication costs) is deposited into the STP, and 1/13th of the STP’s total assets are distributed to:

- veHEMI stakers

- Governance voting participants

- Liquidity incentives (BTC vaults, USD vaults, LP pairs)

- POL Treasury

Meanwhile, the POL treasury collects yield on its positions, allocating a portion of the yield back into its treasury and sending the remainder to the STP pool to be distributed as incentives.

Collectively, this system:

- Buffers asset inflows versus incentive outflows, providing stability

- Continually builds a POL treasury, which provides liquidity to the ecosystem and becomes an evergreen source of yield

- Distributes incentives that:

- Increase the economic security of the protocol (veHEMI)

- Ensure a robust governance system

- Increase liquidity in key protocols

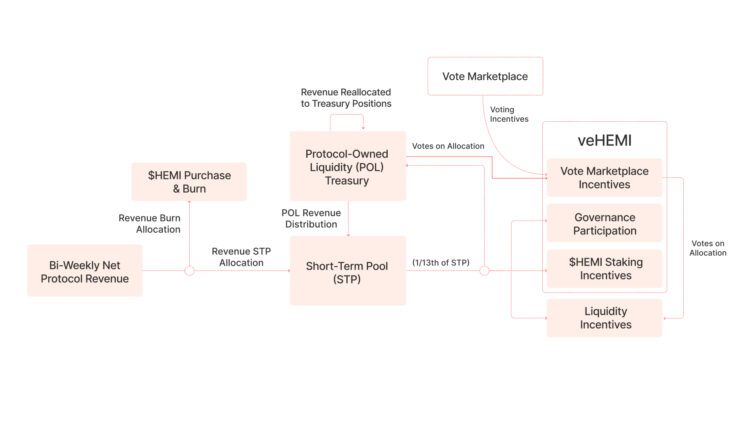

Economic Model Stage 3: Decentralized

Incentive Voting / Vote Market

Stage 3 of the Hemi Economic Model introduces a decentralized voting system based on veHEMI stake weight for directing the allocation of the POL Treasury’s asset allocation and liquidity incentives. It also introduces a vote marketplace which allows anyone to incentivize veHEMI stakers with $HEMI or other tokens to vote for specific allocations of liquidity incentives and POL Treasury assets.

Initially, the POL Treasury will be limited to a set of whitelisted vaults/strategies. Over time, control of these whitelists will be handed over to governance, with a veto committee to protect against malicious strategies.

This system extracts additional value out of liquidity incentives and treasury asset allocation for veHEMI stakers while enabling Hemi’s economic model to become more decentralized and community-guided.

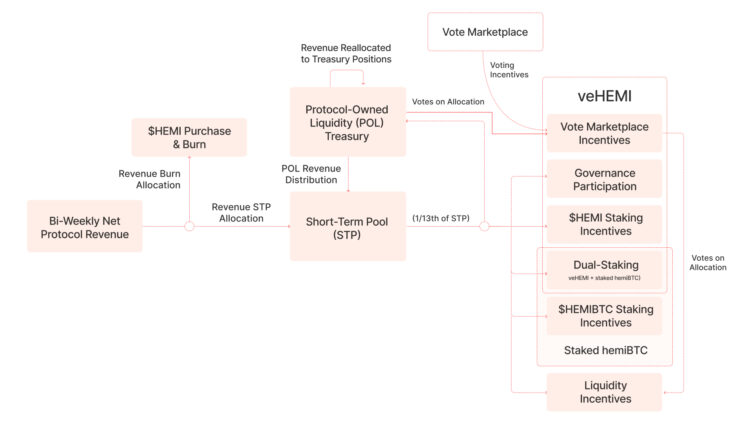

Economic Model Stage 4: Dual-Staking

To stimulate BTC-based economic activity, stage 4 of the Hemi Economic Model introduces staked hemiBTC; a system that incentivizes hemiBTC deposits to be used to create BTC liquidity and encourage economic activity across the Hemi ecosystem. Alongside hemiBTC staking, stage 4 introduces a dual-staking model where participants can increase their BTC yield by also staking $HEMI.

This dual-staking model aligns the incentives of Bitcoin holders with the long-term success of the Hemi protocol, and encourages veHEMI holders to bring more liquidity to Hemi’s Bitcoin DeFi ecosystem.

Participate By Staking $HEMI

All active veHEMI staking positions active between August 30 and October 30, 2025 are eligible for this reward distribution. Stakers can claim rewards directly through the Hemi Portal, which will soon feature UI components displaying estimated APY and streamlined claim functionality. Stake $HEMI now to claim future veHEMI rewards distributions.