- Announcements

- Bitcoin

- Ethereum

- Hemi

- November 26, 2025

The Anatomy of Bitcoin Yield

How the world’s hardest asset actually generates yield across the cryptocurrency industry.

Applied to BTC, the concept of yield presents a conundrum. The language around BTC-derived yield implies earnings from productive activity, yet most mechanisms that have historically produced returns are not grounded in real economic output.

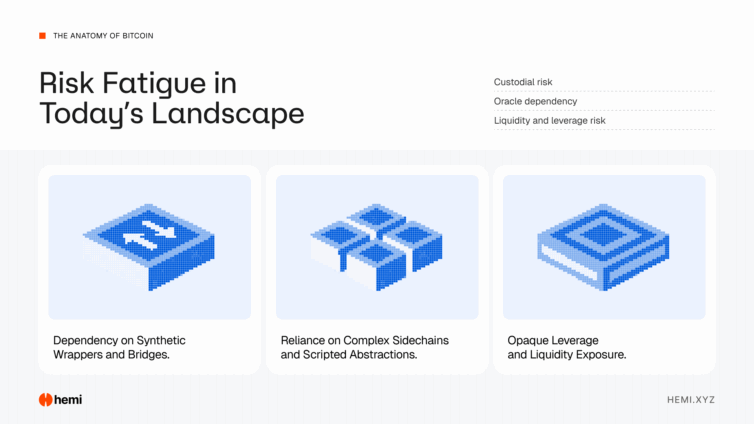

It becomes evident when reviewing the history of centralized lenders, structured ETFs, and custodial desk operations. For such, returns are consistently enmeshed with leverage, maturity mismatches, or rehypothecation, rather than value created directly onchain. These firms turned Bitcoin into collateral for speculative trades or OTC lending, and when liquidity tightens, the entire structure collapses because nothing supports those yields except rolling leverage. The past lessons of Celsius, Voyager, and BlockFi made this clear: constant inflows, high leverage recycling, or opaque off-balance sheet positions create structural fragility rather than sustainable yield.

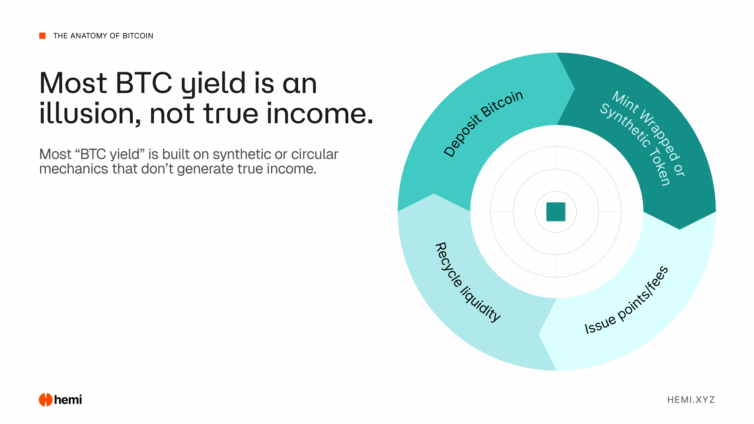

Even as the industry shifts toward integrating Bitcoin within DeFi, yield remains largely synthetic. Many yield products operate on alternative Bitcoin layers that rely on wrapped representations or bridged derivatives. Users are often told they are earning from Bitcoin activity, but what they actually hold is a tokenized claim that depends on custodial validation, not onchain mechanics. These systems import liquidity and create leverage, but they do not create real yield. They recycle demand from traders and mint new derivative markets around a facsimile of an asset, while underlying Bitcoin remains siloed.

Newer products sometimes attempt to disguise this with complex language. Collecting yield is reframed as market making or structured vault activity, yet the mechanics still rely on counterparty risk, synthetic instruments, or exposure to wrapped assets. Very little of this is tied to the productive capacity of Bitcoin itself, and the net effect is a market full of instruments that reference Bitcoin but rarely generate yield directly from it.

What Does Productive BTC Yield Actually Mean?

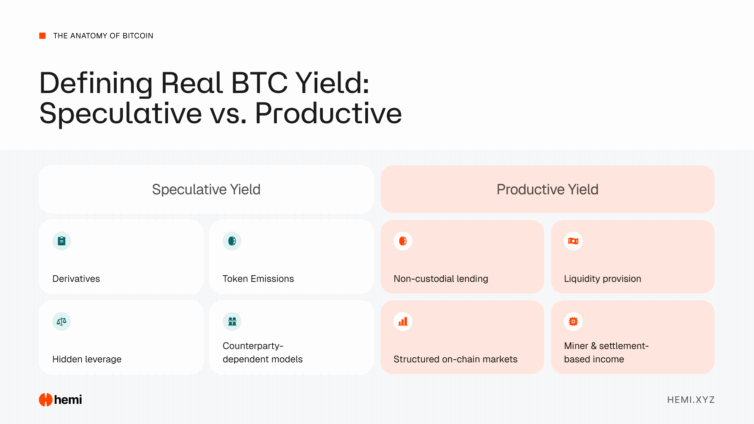

Real yield originates from observable, measurable, onchain activity. It does not depend on external balance sheets, offchain leverage, or custodial fulfillment; instead, it arises from economic activity that Bitcoin users participate in. This activity includes providing liquidity to markets, engaging in automated lending, enabling settlement infrastructure, or supporting structured products that derive value from transparent mechanics rather than hidden leverage.

The premise of productive yield is grounded in operations that return value to the user because their assets contributed to protocol-level function, not because a custodian executes proprietary trades. This distinction becomes important when mapping speculative yield against productive yield.

Speculative yield is produced when Bitcoin is loaned to a counterparty who uses it to generate returns through market exposure or leverage. Productive yield is produced when Bitcoin is placed into onchain systems that use fully transparent logic to produce returns without altering the custody relationship.

Unlike speculative yield models, users participating in productive yield maintain control of their asset; the protocol operates, and value flows back to the participants for services provided. Over time, this creates a structure where yield reflects the demand for actual services rather than the ability of a custodian to execute profitable trades. This shift reinforces protocol sustainability and real-time auditability.

Changing BTC To An Active Trillion-Dollar Asset

Why does almost all of the capital behind Bitcoin remain idle? In part, this stems from risk aversion and a lack of supportive infrastructure for BTC-enabled yield with self-custody. For instance, institutional holders generally avoid moving their positions because yield products have historically required relinquishing custody or relying on wrapped tokens, which introduce centralization risks.

Retail users face the same problem. Most Bitcoin holders want to keep control over their keys and avoid synthetic assets. In a market where the mantra “Not your keys, not your crypto” reigns, retail users want Bitcoin, not a derivative or representation created by someone else. The demand for yield is high, but the yield market hasn’t historically aligned incentives with core Bitcoin values. That misalignment forces most holders to choose between security and productivity, often resulting in long-term holders opting for security and forgoing opportunities to grow their position.

Asset managers and allocators want yield that fits within compliance frameworks, provides transparency, and falls within custody standards. Retail holders want yield without opaque intermediaries. The absence of a model that satisfies both groups has left Bitcoin an enormous yet untapped reservoir of productive capital. Solving this problem requires a shift from custodial yield models to onchain mechanisms that preserve the integrity of Bitcoin while enabling observable economic activity.

The Future Of Bitcoin Yield

The industry is transitioning away from models that rely entirely on trust or intermediaries. The failures of centralized lenders accelerated this shift, demonstrating transparency as a basic requirement as opposed to an aspirational feature, particularly amid highly volatile market conditions. The next phase of Bitcoin yield will be characterized by systems that produce returns through transparent logic, automated settlement, and onchain, verifiable asset flows.

The shift toward verifiable yield will also redefine institutional expectations. Funds need systems that satisfy compliance, allow for independent auditing, and maintain strong custody assurances. Onchain infrastructure satisfies all three. Eventually, these requirements will create a unified market structure where users at every level may participate in transparent, secure yield models aligned with Bitcoin’s ethos.

Hemi and the Productive Era of Bitcoin

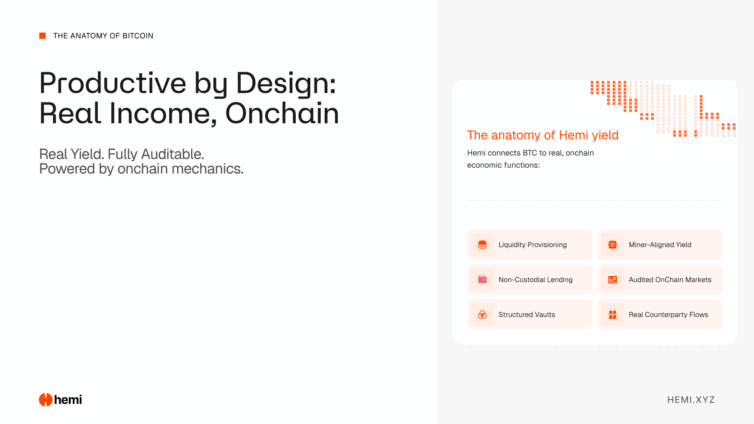

Hemi is a pioneer of productive Bitcoin, providing the infrastructure needed to unlock real BTC-enabled yield grounded entirely in transparency and onchain mechanics. It connects Bitcoin directly to an EVM environment with a protocol that can support lending, liquidity systems, structured markets, automated vaults, and more. Hemi’s trust-minimized tunnels support liquidity inflows from Bitcoin and EVM chains, eliminating the need for custodians or wrapped tokens. Settlement occurs through verifiable logic, and users retain control of their Bitcoin throughout the entire process.

Hemi is the key to unlocking trillions of native BTC liquidity, unleashing the floodgates for it to become activated across the entire EVM-based DeFi ecosystem. It enables BTC to participate in productive economic activity across a wide array of existing applications. Developers can build DeFi applications in the familiar EVM space they’ve grown accustomed to, with native access to Bitcoin’s state data and deep liquidity. Institutions gain a platform that satisfies security, custody, and audit requirements. For retail users, BTC yield becomes attainable without accepting custodial risk. These features create a convergence layer where every participant can interact with BTC in never-before-possible ways.

As the market moves into a new phase defined by provable yield, Hemi becomes a foundation for the productive layer of the Bitcoin economy. With Hemi, Bitcoin no longer sits idle; it earns through real, onchain mechanisms that align directly with retail and institutional demand.