- Announcements

- Bitcoin

- Ethereum

- Hemi

- April 30, 2025

The Hemi Mainnet Guide

Hemi has grown since mainnet launch, with more ways than ever to put your portfolio of Bitcoin and EVM-based assets to work.

Since Hemi’s mainnet milestone, the network has amassed over $1 billion in TVL. Hemi now stands at the peak of the Bitcoin L2 landscape, standing apart as the one network that truly unifies the ecosystems of Bitcoin and Ethereum.

This guide will walk you through what we’ve added since launch and then wrap up with everything you’ve been able to do since the beginning. Questions? Join our Discord. Hemigos are always happy to help.

Table of Contents

What’s New

Since going live, even more protocols have joined Hemi, providing users a way to activate both EVM-based assets and Bitcoin in DeFi. Protocols like:

Raga

Raga’s automated vaults on Hemi support Bitcoin-native and stablecoins, with future support coming for EVM-based assets via Hemi tunnels. The protocol’s one-click strategies help to reduce steps for yield strategies with effortless rebalancing. Built directly into the hVM, Raga minimizes trust assumptions, so that Bitcoin holders can participate in dynamic cross-protocol yield strategies without a complex setup.

Satori

Satori is the first perpetual DEX on Hemi, so users can trade perps at leverage for Bitcoin and other assets. Satori also supports vaults with on-chain yield and trading strategies. Satori offers long or short positions at 50x leverage for BTC and ETH, or 25x leverage for dozens of other supported assets. With non-custodial vault access, the protocol focuses on security and optimization, expanding structured yield product options for Hemi traders.

Spectra

Spectra pools on Hemi bring fixed-rate options and yield leverage products, seeded with over $18 million in liquidity. Users can lock in fixed yields or wield up to 34x leverage for notional exposure on Bitcoin-native assets. Spectra’s foundational DeFi primitives, Principal Tokens (PT) representing fixed rate positions, and Yield Tokens (YT) representing leverage-based positions trade on Hemi pools, earning swap fees, fixed rate returns, and native asset yields for liquidity providers.

Follow these tutorials to use Spectra:

Relay

Relay and Hemi team up for cross-chain payment execution across Bitcoin and Ethereum via an optimistic execution model. Relay brings rapid transaction settlement, minimal gas costs, and features allowing for seamless bridging, NFT minting, and gas abstraction.

ZNS Connect

The integration of ZNS Connect and Hemi brings human-readable names and domain tools that developers and users on Hemi can use to create secure, alphanumeric wallet identifiers that work across blockchains. They can also access apps, DEXs, and other tools directly via their .hvm domain. With .hvm domain support, users can access personalized Web3 pages, manage a digital identity, and interact with Hemi-based apps that support ZNS names.

1Delta

1Delta brings Hemi an all-in-one aggregator that reduces DeFi complexity, combining swaps, bridging, margin trading, and 1-click leverage into a single platform. 1Delta routes across numerous potential paths to ensure the most optimal gas prices for swaps. 1Delta also allows users to open and close long and short positions easily. By connecting with existing lending protocols, 1Delta facilitates the swapping of collateral or debt-based assets without needing to unwind the assets.

eOracle

eOracle and Hemi are working together to bring users dedicated, reliable price feeds that support DeFi apps connecting to Bitcoin and Ethereum. This integration allows partners, such as LayerBank, Satoshi Protocol, ZeroLend, and Bima, access to accurate price data, ensuring stable and secure smart contract operation.

Allora Network

Allora Network and Hemi integrate AI-powered price prediction for BTC and ETH price feeds, generated by Allora’s self-improving collective intelligence network. This gives developers tools to build for improved yield optimization, reduces the risk of volatility, crowdsources market signals, and supports the engineering of new protocols.

Relend Network

Relend Network and Hemi are collaborating with rUSDC-hemi, a stablecoin that offers deep liquidity and stability to the network’s Bitcoin-based DeFi applications. By relending liquidity from the Ethereum Mainnet, Relend Network offers a collateralized debt position (CDP) stablecoin in rUSDC-hemi. This allows users to mint rUSDC-hemi by supplying USDC on the Ethereum Mainnet and bridging to Hemi, borrow rUSDC-hemi from local markets, redeem rUSDC-hemi at a 1:1 ratio for USDC, and use rUSDC-hemi for seamless liquidity across Hemi’s DeFi ecosystem.

Day One Launch Partners

Alongside our new partners, Hemi’s Day One protocols cover the full gamut of on-chain activities for a Bitcoin and Ethereum-aware Layer 2 network:

Sushi allows for swaps of Bitcoin and EVM tokens with low slippage using a familiar AMM-powered DEX experience fully integrated into the Hemi ecosystem.

iZumi offers access to multi-chain liquidity through concentrated liquidity positions designed for capital efficiency and yield optimization.

DODO allows you to trade using a Proactive Market Maker (PMM) model, offering single-sided liquidity and slippage reduction for more efficient swaps.

Oku (Uniswap Interface) provides manageable liquidity positions and trade execution with advanced analytics, limit orders, and fiat onramps, all through a unified dashboard.

PassDEX offers swaps, liquidity provision, and rewards within a community-driven, gamified trading environment.

LayerBank allows for lending and borrowing of Bitcoin and EVM assets with institutional-grade liquidity pools and competitive interest rates.

LendOS offers flexible decentralized lending solutions tailored for both retail and DeFi-native users.

ZeroLend enables participation in DeFi lending, LRT lending, and RWA markets using a custody-free, fully audited platform.

AJNA facilitates lending and borrowing in governance-dependency-free peer-to-pool positions

without external price feed reliance.

Hemi native tunnels allow for Bitcoin and Ethereum assets to move to Hemi through non-custodial tunnels.

Stargate powers instant cross-chain swaps, with finality and no wrapping, optimizing liquidity flows.

Meson enables stablecoin swaps across multiple networks efficiently with minimal slippage and fees.

OOOO is an automated, AI-enhanced cross-chain protocol to simplify interoperability between blockchains.

BitFi lets anyone earn yield on Bitcoin assets through a fully transparent custody and quantitative trading platform.

DeSyn offers custom onchain portfolios managed through secure, smart contract-driven systems.

VaultCraft maximizes yield with deposits into delta-neutral vaults managed by leading DeFi strategists.

Satoshi Protocol allows for the minting of satUSD by collateralizing Bitcoin, opening up broader stablecoin use cases in DeFi.

Sumer.Money supports suUSD, suETH, and suBTC synthetics with correlated and uncorrelated asset strategies.

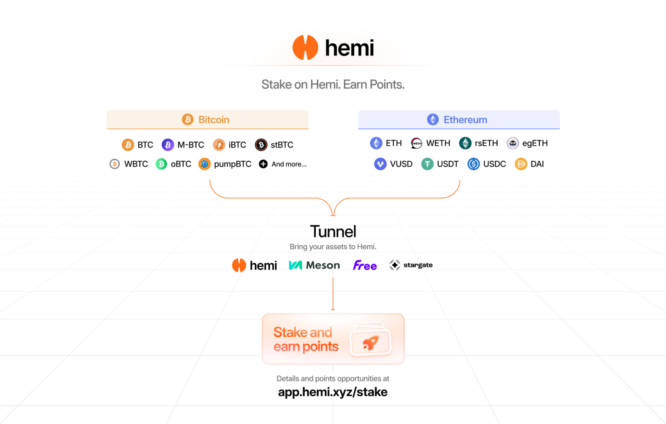

Hemi supports staking for a wide range of Bitcoin and EVM-based assets, all under one roof. Move in and out of staking positions in minutes via a dedicated smart contract without slashing risk, as no staked assets are used for block validation.

Cygnus facilitates restaked liquid assets efficiently across networks, maximizing delegation rewards with minimal manual effort.

Pell Network offers an omnichain restaking platform, helping secure multiple decentralized validation services.

Use Protocols On Hemi and Earn Points

Celebrating the successful mainnet launch and ahead of the token generation event, the Hemi Points program offers ways to maximize earning potential with points multipliers for providing liquidity, swapping, staking, and more. See the full list of points-earning activities on the Hemi Points dashboard.

Hemi lets you do more with your digital assets, including Bitcoin. See how to put your portfolio to work, start earning rewards, and climb the leaderboard on Hemi today.